Beacon Platform Inc.’s global research reveals hedge funds’ top risks include inflation, geopolitical instability, and asset volatility. The study underscores the need for robust risk management systems to navigate volatile markets and informed decision-making.

As hedge funds deal with global risks and unpredictable markets, their executives are increasingly focused on keeping control over changes to their models and algorithms. They also aim to improve their understanding of overall investment risks, according to new global research by Beacon Platform Inc.

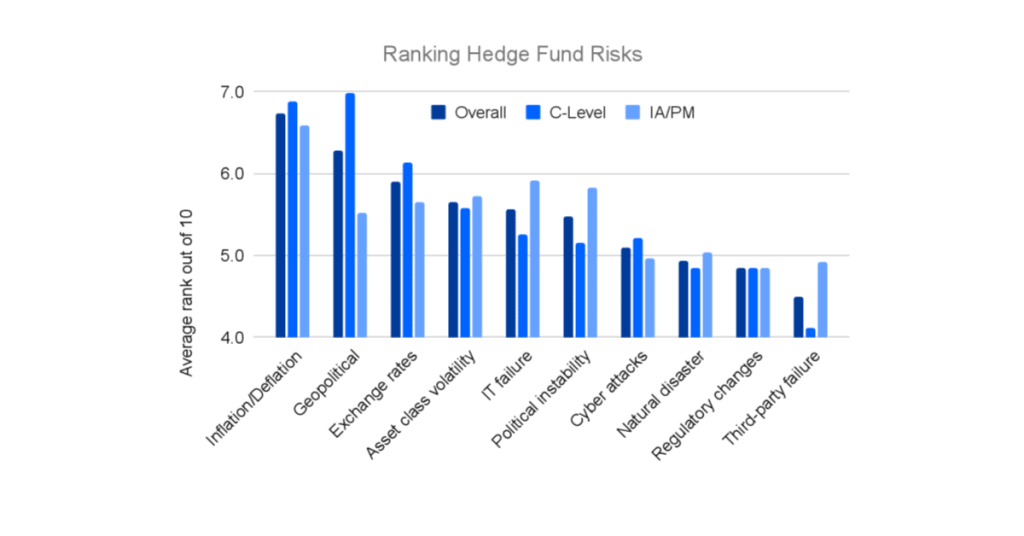

A group of hedge fund executives was asked to rank 10 key risks affecting the industry today. They identified inflation or deflation and geopolitical issues as their top two concerns. These were followed by risks related to exchange rates and asset class volatility. The risks they worried about the least were third-party failures and regulatory changes.

There was a noticeable difference in how risks were ranked by top executives compared to investment analysts (IA) and portfolio managers (PM). IT failure was ranked as the second-biggest risk by analysts and portfolio managers, while executives did not consider it as critical.

The largest hedge funds, which manage between $25 billion and $50 billion in assets, were much more concerned about inflation or deflation (rating it 8.7 out of 10) and geopolitical instability (rating it 8.1 out of 10). Their level of concern was 30% higher than the average across all surveyed executives.

This study, which surveyed 100 senior hedge fund executives from the US, UK, Germany, Switzerland, France, Italy, Sweden, Norway, and Asia, represented a total of $901 billion in assets under management. The research highlighted the most pressing risks for hedge funds, but the key question remains: how can these firms improve their risk management strategies and build stronger systems to handle increasing risks and market volatility?

Risk management challenges in hedge funds

Executives were also asked to rank the main challenges hedge funds face when managing risk. The biggest concern was controlling models and algorithms, followed by understanding the fund’s overall exposure and reducing delays in getting results from complex risk calculations.

When evaluating their own risk management systems, hedge funds believed they were strongest at covering all traded products within the same system. However, they rated themselves weakest when it came to reducing calculation delays.

This research shows that hedge funds are actively working to address growing market risks, but they still face significant challenges in improving their risk management systems.

Concerns and Capabilities Vary by Size of Hedge Funds

As hedge funds grow in size, their main challenges and capabilities tend to shift. The smallest funds surveyed, with less than $1 billion in assets, are most focused on improving accuracy, understanding their exposure to risks, and ensuring their systems are adaptable as they develop their risk management systems.

The next group of funds, with assets ranging from $1 billion to $10 billion, are more focused on controlling models, reducing calculation delays, and improving the resilience of their systems. These funds need to handle more models and manage more complex and diverse assets.

For the largest funds, managing between $10 billion and $50 billion, the priorities shift to ensuring their systems can fully cover their broad range of assets, accurately calculate the risks they are exposed to, and provide results quickly so that these results can be acted upon effectively.

In summary, as hedge funds grow larger, they face different challenges and need to focus on improving different aspects of their systems to manage risks more effectively.

Kirat Singh, CEO and Co-Founder, Beacon Platform Inc. said:

“As geopolitical risks continue to grow and bring with them renewed threats of inflation or deflation and increased volatility, our research shows that hedge fund executives are turning their attention towards the capabilities that they will need to prosper in this environment. As a provider of risk management systems, our job is to make sure that hedge funds can, in a timely manner, figure out where their edge is, trade the risks that they want to take, and manage the portfolio lifecycle. Because if you don’t understand your risks, you can’t take the right risks.”

The Beacon executive team, selected partners, and interested clients will be looking at this research and discussing issues related to hedge funds at the company’s annual Inspire conference, titled “The Power of Informed Risk: Building Resilience In Volatile Markets”. This event will take place in London on April 3rd, 2025.

About Beacon

Beacon is a financial technology company that provides all the tools that quantitative developers need to quickly build, test, deploy, and share trading and risk applications, analytics, and models. Beacon’s platform was developed by a team with extensive experience in financial markets. It offers a unified system that includes apps, tools, and infrastructure needed by firms to move their software and infrastructure to the cloud. It also helps manage risk across all asset types and focuses on building innovative strategies that give firms a competitive edge.

Read More:

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.